Fast, convenient and secure

The HSBC UAE app lets you securely manage your accounts and investments anytime, anywhere. This makes banking more convenient and gives you more time to yourself. Using the app is easy, but if you need any help we're available 24/7 on the mobile chat feature.

To download the app please make sure you first register for online banking. If you're already registered you can get the app now.

Local and global banking in a flash

More reasons to get the app

Easy account opening

Opening an account is now even easier through the app – register, set up and start using your account in just a few minutes.

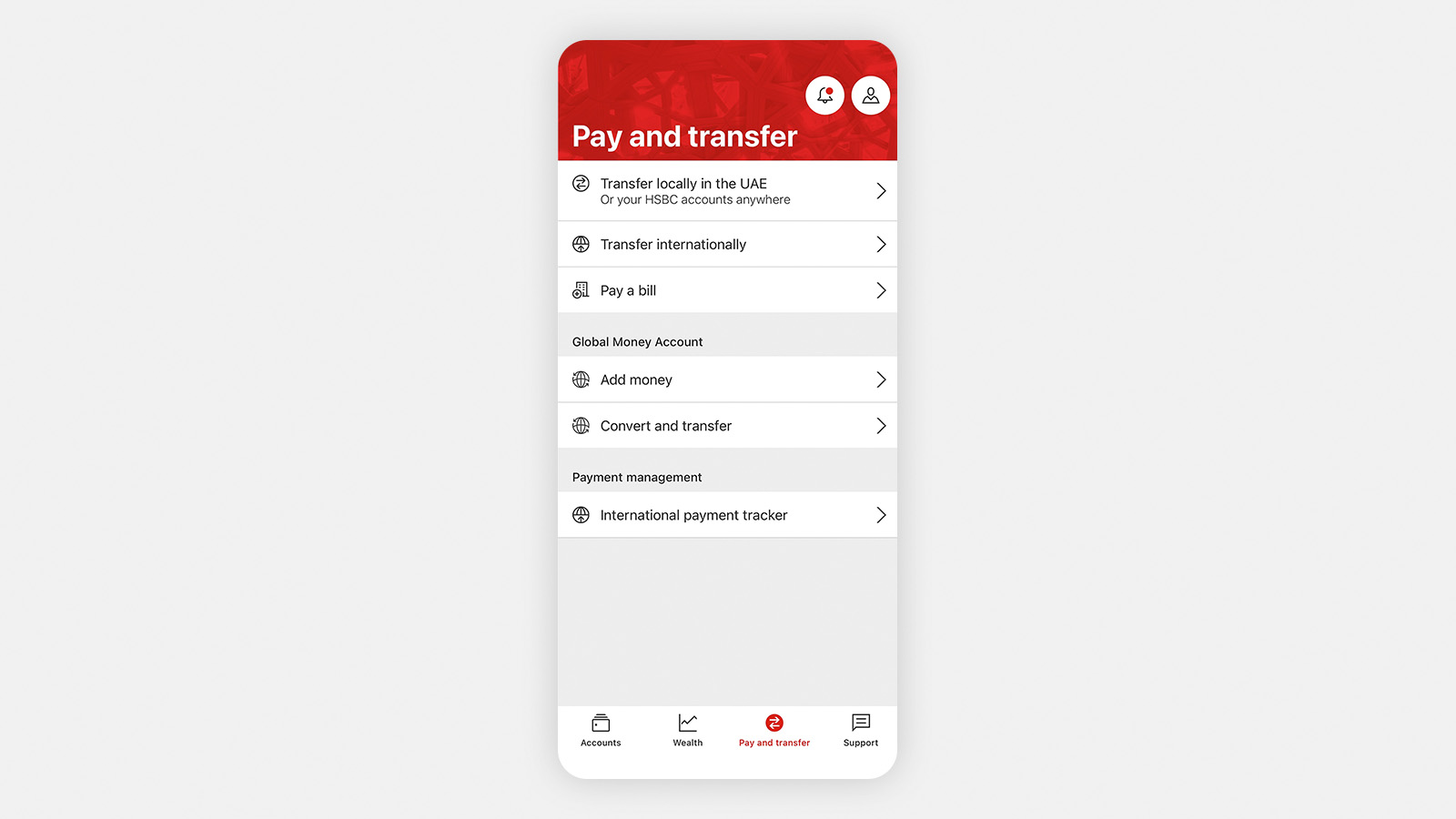

Make payments

Add new domestic and international payees, make payments and transfer money.

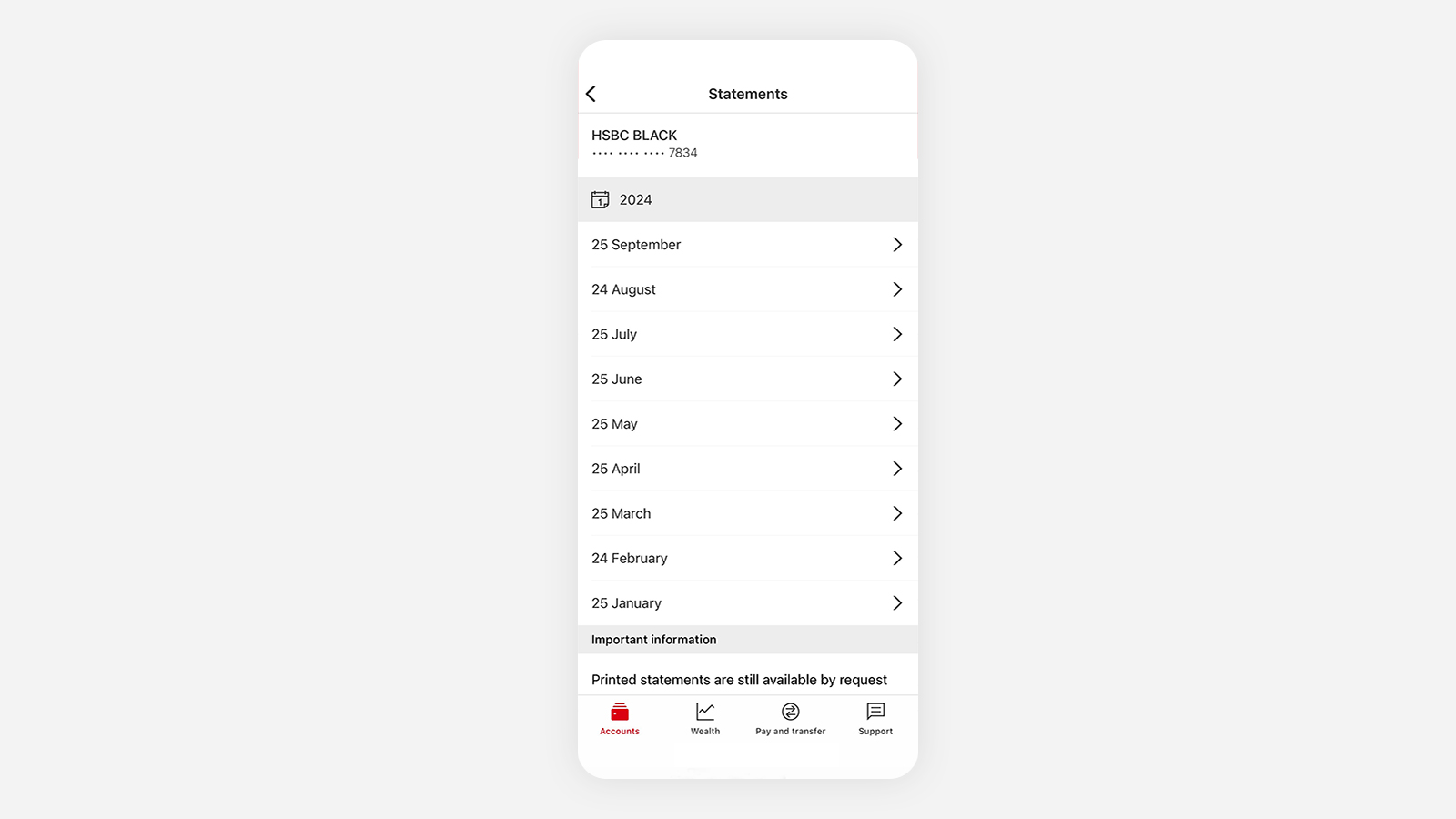

View statements

Review your spending in seconds, wherever you are. Just select your account or credit card, then tap 'View statements'.

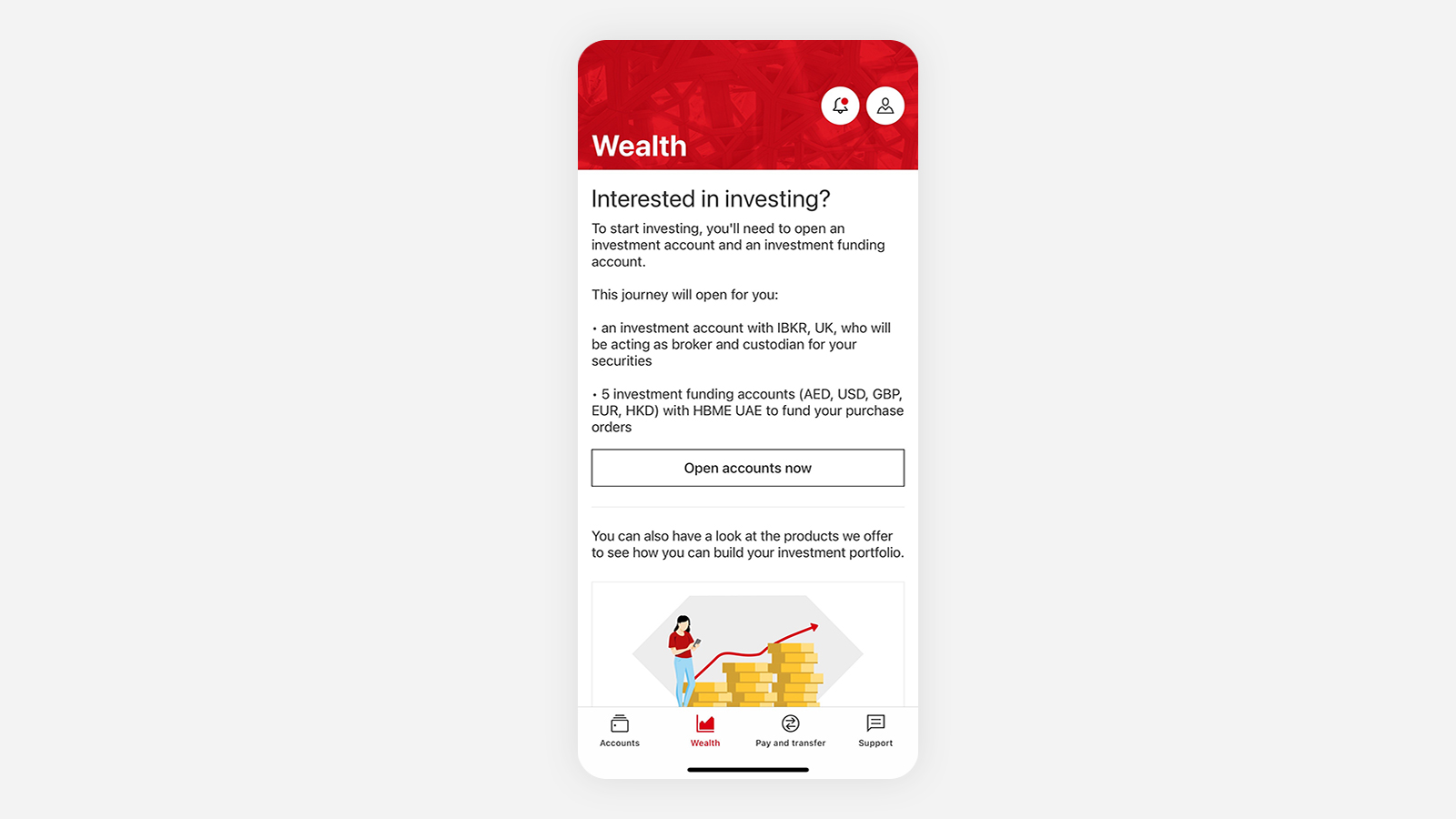

Invest on the go

View and manage your investments anytime on our WorldTrader platform, with competitive transaction fees as low as 0.01 USD per share.

Access the world with one account

Hold and manage 21 currencies with a Global Money Account. Select 'Global Money Account' under 'Products & services'.

For more than just everyday banking

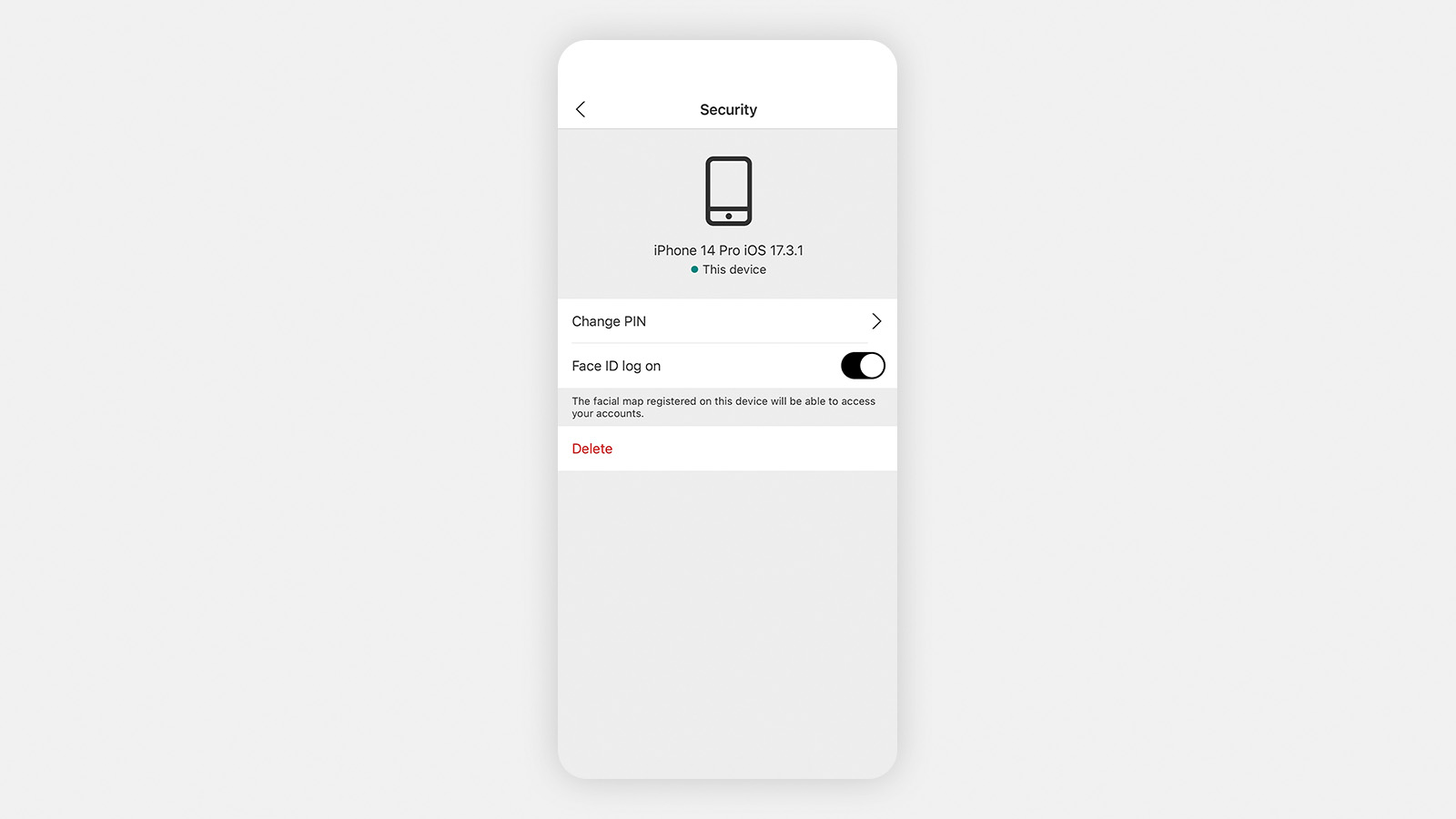

Security is our priority

We are constantly innovating to protect you and your money. Our app has a host of safety features:

- Digital Secure Key provides an extra layer of security

- If your card is lost or stolen you can temporarily block it – and unblock it if you find it