| What is a Cash Instalment Plan? |

-

Competitive interest rates

-

No early settlement or processing fees

-

Quick and easy to apply

-

Manage your spending with repayment plans ranging from 12 months to 4 years

-

Have the money paid into your HSBC account or any UAE current or savings account in your name – whatever’s most convenient

| Get a Cash Instalment Plan |

| How does a Cash Instalment Plan work? |

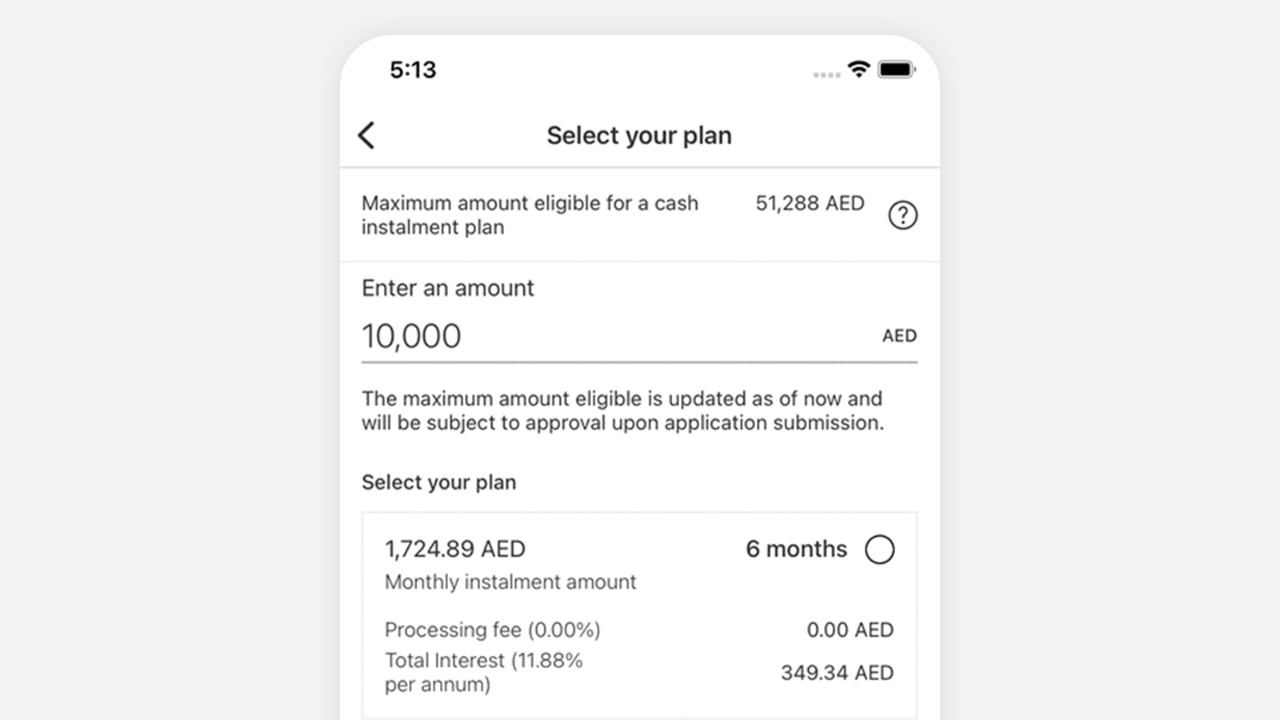

You can apply to borrow any amount starting from AED 3,000, as long as you don’t exceed your credit card limit. And you can choose to pay it off over 12, 24, 36 or 48 months. The terms we can offer you will depend on your circumstances.

Apply using your HSBC UAE app

Step 1: Select one of your credit cards

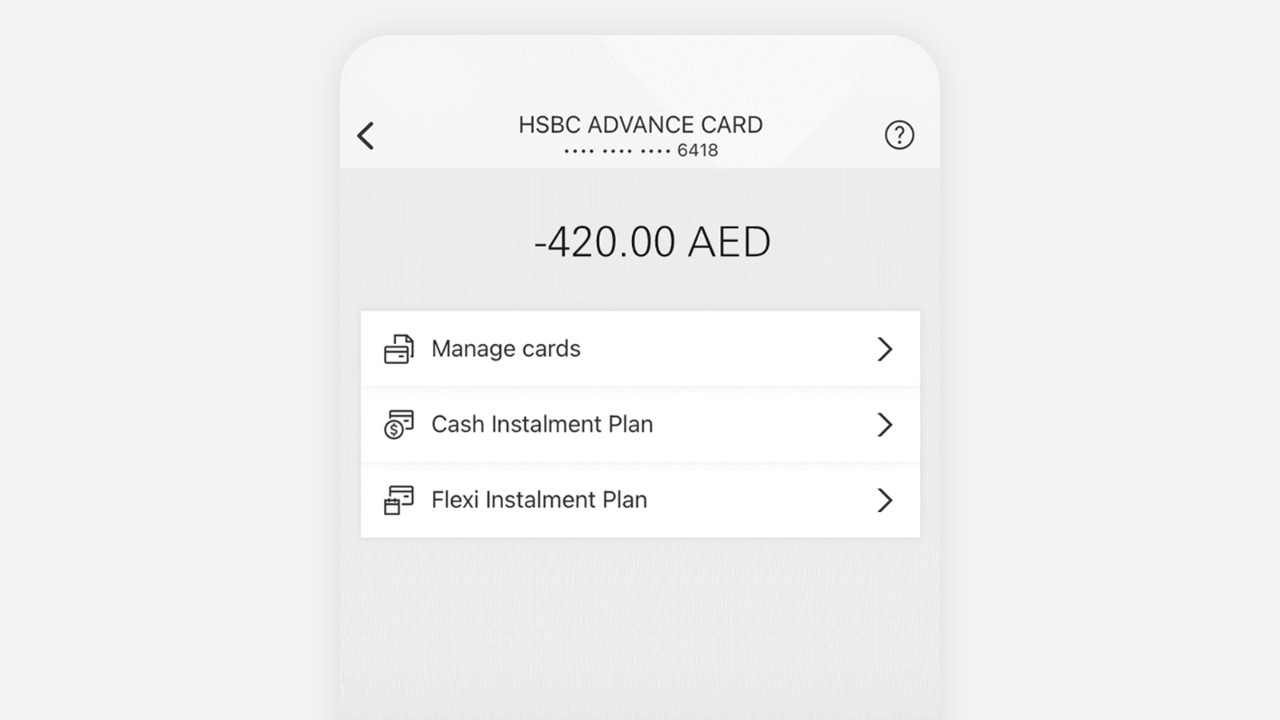

Step 2: Tap on Cash Instalment Plan

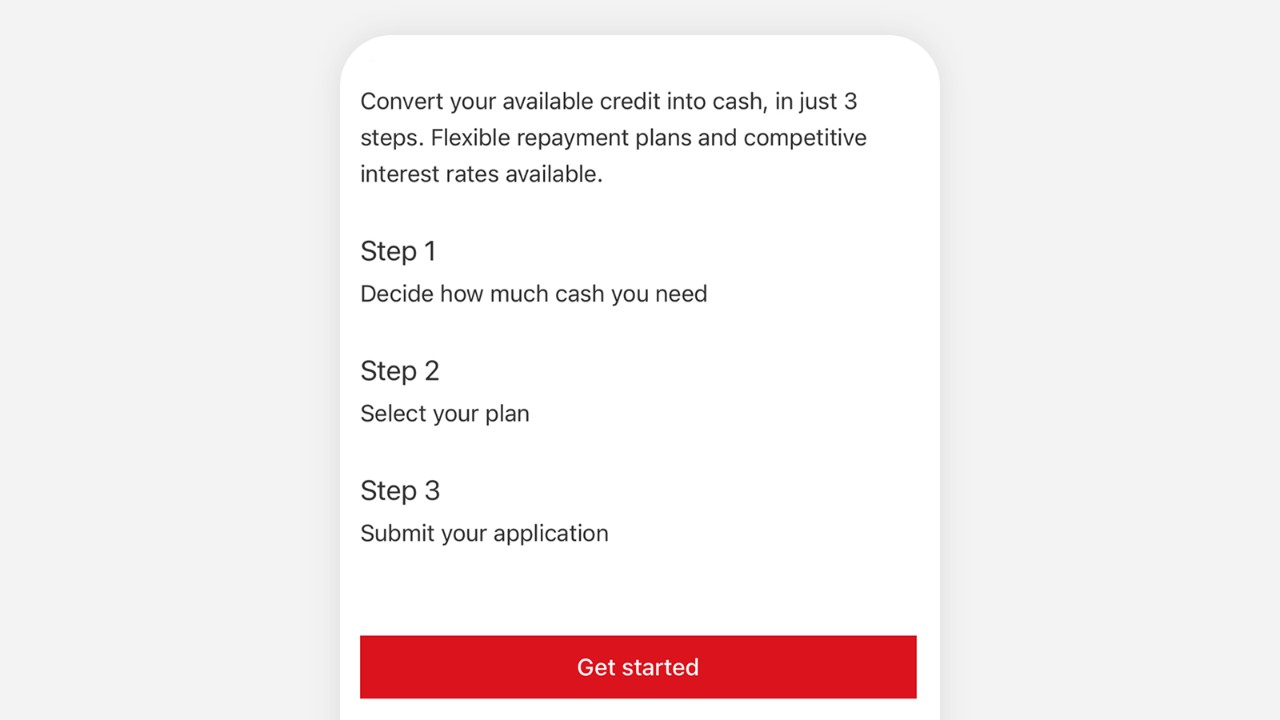

Step 3: Tap on Get Started

Step 4: Enter your plan details

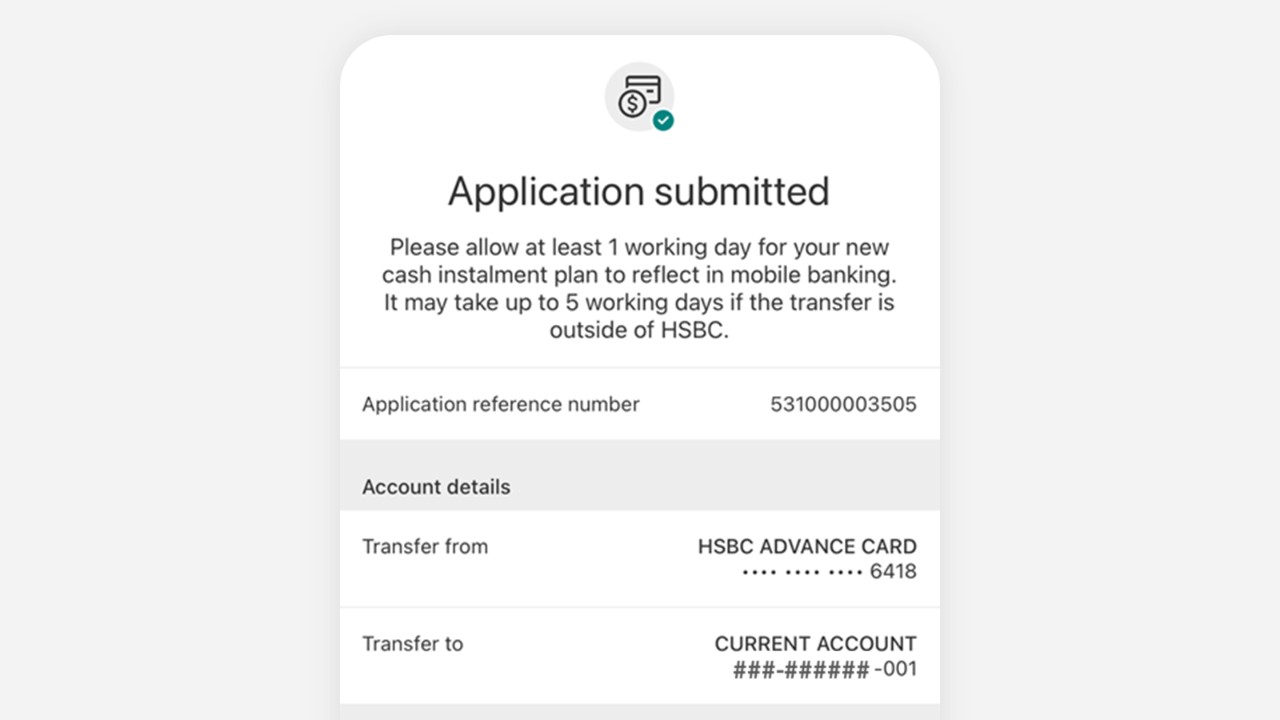

Step 5: Instant application confirmation

| Things you should know |

We'll evaluate your application based on your financial history and current circumstances. This will be part of your monthly minimum credit card repayment.

Fixed Annual Percentage Rate - 7.08% to 29.88% on reducing balance. The interest rate offered will be dependent on your individual circumstances and the plan term.

Cash Instalment Terms and Conditions and the Schedule of Services and Tariffs apply.

If you do not meet the repayments/payments on your loan/financing, your account will go into arrears. This may affect your credit rating, which may limit your ability to access financing in the future.

| Who can apply? |

To apply for a Cash Instalment Plan you'll need to have:

- a HSBC UAE credit card

- a current or savings account with any bank in the UAE

Sometimes we'll ask you for proof of income, but we don't usually need to do this.

Apply

Through the mobile app

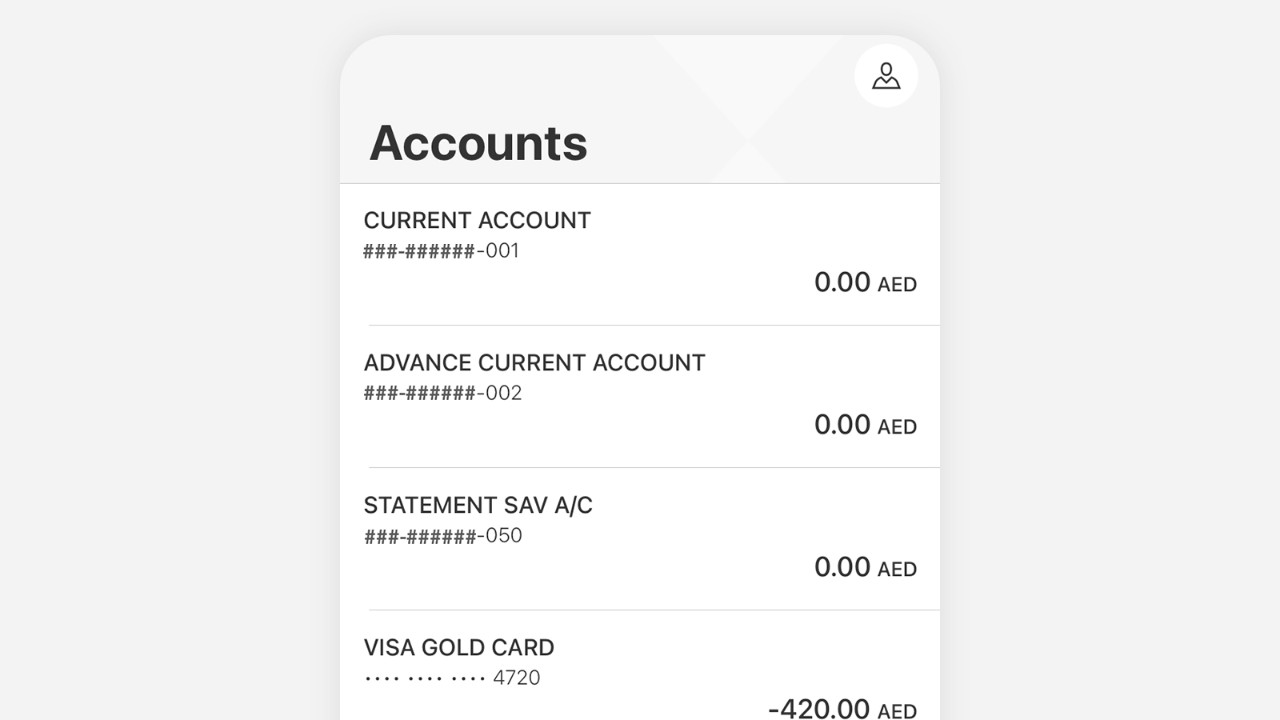

- Log on to the HSBC UAE app.

- Select the credit card you want to transfer cash from

- Tap Cash Instalment Plan' and select 'Get started'.

- Choose the amount and repayment plan that works for you and select 'Confirm'.

| Have us call you |

You may apply by calling us, through our online banking secure message facility or by following instructions provided in any communications sent in this regard and we will call you within 24 hours.

By phone

Premier customers

Call us on 800 4320 (within UAE) or +971 4 224 1000 (outside UAE).3

Advance customers

Call us on 600554722 (within UAE) or +9714 2288007 (outside UAE).3

Personal banking customers

Call us on 600 55 4722 (within UAE) or +971 4 228 8007 (outside UAE).3

Frequently Asked Questions

| Don’t have a HSBC credit card? |

HSBC Black Credit Card

From travel to culinary experiences, culture and shopping there's no limit to where the benefits can take you.

HSBC Cashback Credit Card

Earn up to 5% cashback on your everyday spending.

HSBC Zero Credit Card

Enjoy no interest on purchases for the first 3 months.

HSBC Advance Credit Card

Enjoy great travel benefits, Air Miles on everything you spend and a competitive interest rate.