22 Apr 2024

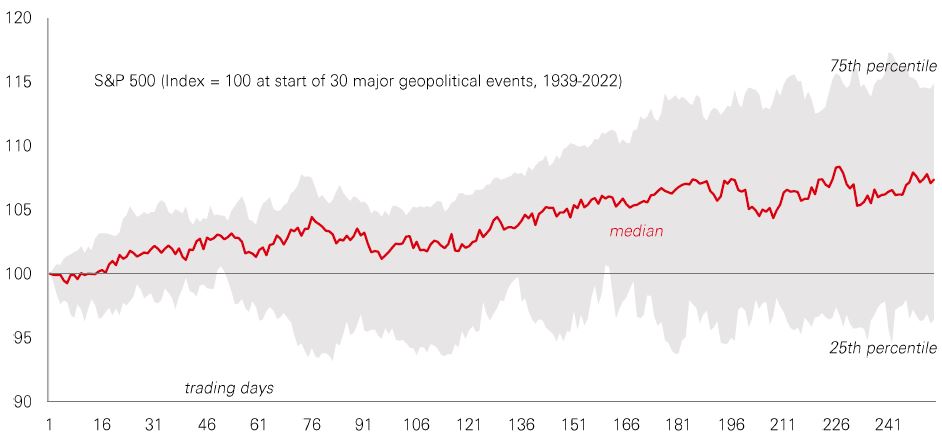

The recent escalation of events in the Middle East puts geopolitical risk back on the radar for global investors. Typically, geopolitical shocks – and a higher geopolitical risk premium – mean spikes in market volatility, higher correlations among risky assets, and risk-off moves favouring safe-havens.

But history also tells us that most geopolitical events have short-lived effects on markets. The general pattern is for an initial wobble in stocks, followed by market gains. But there is a caveat: some geopolitical events have resulted in much bigger-than-average stock market drawdowns. And several have had much longer durations.

The 1973 Oil Crisis stands out as a far-reaching and highly impactful event for investment markets. The shock tipped the world into recession in 1973-5, and toward a stagflation equilibrium.

In the current situation, the good news is that Saudi Arabia, Kuwait, and the UAE are sitting on more than 5m b/d of spare capacity, implying room to replace lost Iranian barrels. The US and China also have strategic reserves, and shale is now a big factor in US energy independence. Western economies are less oil-intensive than they were in the 1970s.

Increased market volatility may create an opportunity for contrarians to get long on risk assets. But at this juncture, risk premiums embedded in many Western asset classes look low. Elevated geopolitical risk is likely to be a feature, not a bug, of the ‘multi-polar’ international system.

Over the past six months, bonds issued by emerging markets with the B and C rated buckets (lowest credit ratings) have returned 14% and 46% respectively versus a total return of 10% for the broader Emerging Market Bond Index.

Three factors have driven outsized returns. First, lower food and energy prices have helped improve terms of trade allowing economies to return to growth and easing external financing needs. Second, support from international financial institutions has lowered credit risks in countries like Egypt and Pakistan, and in some cases, even allowed countries like Kenya to return to international capital markets. Finally, new governments have pivoted to sustainable policies in Türkiye, Argentina, and Ecuador.

The punchline here is with more sustainable policies and IMF programs in place, outperformance in these idiosyncratic stories can continue even in a challenging macro environment for fixed income.

The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested. Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future.

Source: HSBC Asset Management. Macrobond, Bloomberg. Data as at 11am UK time 19 April 2024.

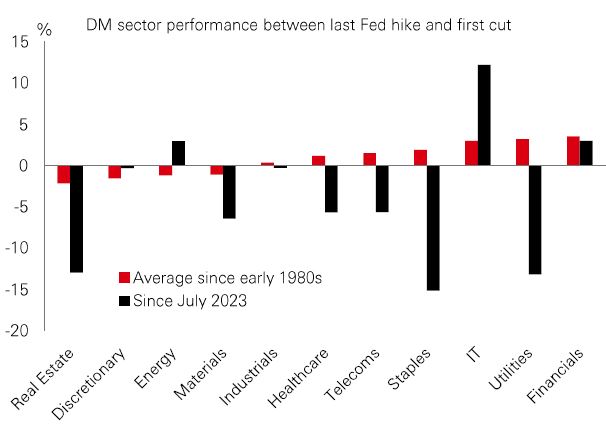

Since the Fed’s last rate hike in July 2023, defensive sector stocks – usually classic safe-havens – have been some of the market’s biggest losers. Relative sector performance in past cycles suggests that’s unusual. Since 1984, sector winners between the last hike and first cut have been, on average, Staples, Utilities, Technology and Financials. While Tech has been a big winner this time, the two defensives – Staples and Utilities – are both down by around 15%.

Today, Developed World Staples offer an excess dividend yield of 110 bps versus the market – about five times the 20-year average. Utilities offer an excess yield of 70 bps. And in the US, it’s only the second time in 40 years that the price-book ratio of Staples is below the market.

For investors, this relative underperformance could point to a source of cheap protection against adverse economic outcomes. And even in the absence of growth shocks, further disinflation and lower bond yields would likely benefit these sectors.

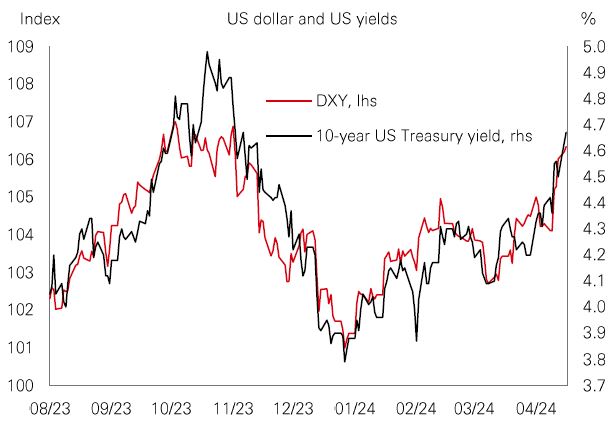

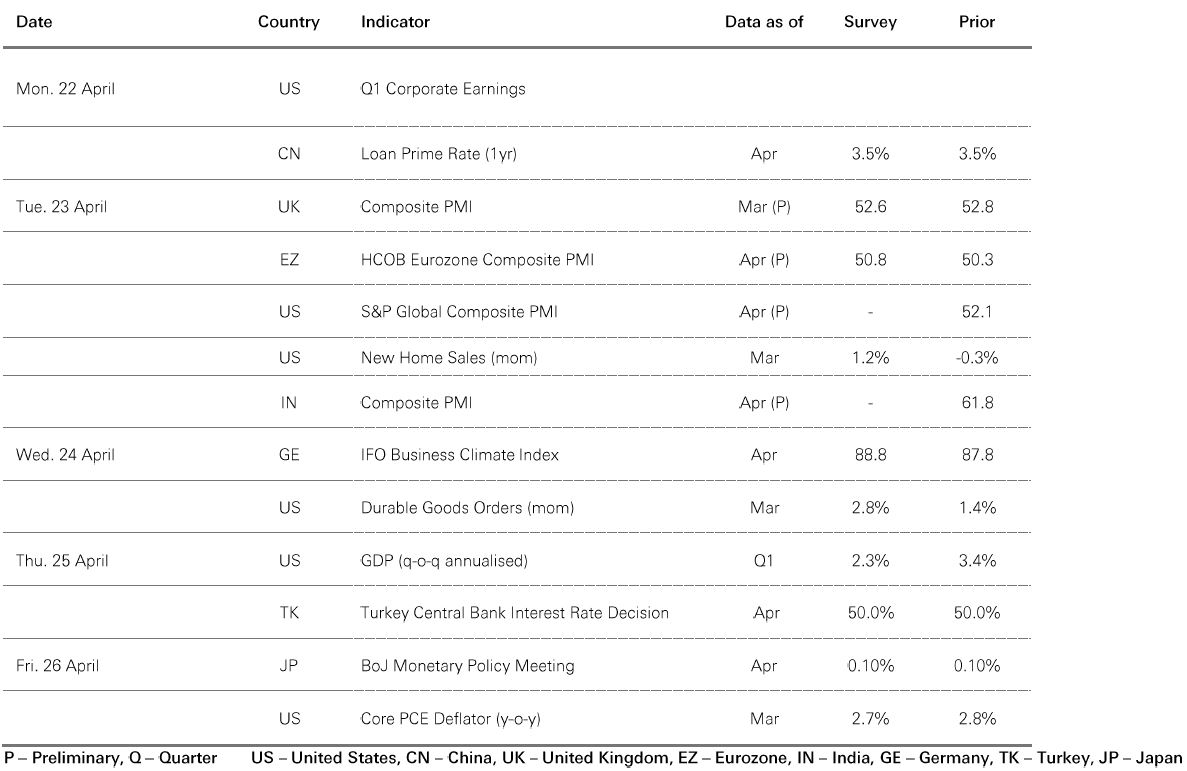

The latest IMF World Economic Outlook (WEO) forecasts highlight the widening divergence between growth in the US and other developed market economies. The IMF revised up its 2024 US GDP projection by 0.6pp to 2.7%. Europe was revised lower, Japan left unchanged, with both expected to grow by less than 1%.

This outperformance of US growth, and concerns that it may further hamper any progress on the inflation front, is playing out in bond markets and spilling into risk markets. The 10-year US Treasury yield has jumped by around 40bp since end-March as investors revise their assumptions around the timing of Fed rate cuts. This has coincided with a 5% month-to-date drawdown in the S&P 500.

And although strong US growth supports the domestic earnings and defaults outlook, limiting the downside, investors need to monitor the potential spillover effects to the rest of the world. In particular, the recent surge in the US dollar will have important implications, not least crimping the ability of many global central banks to ease policy.

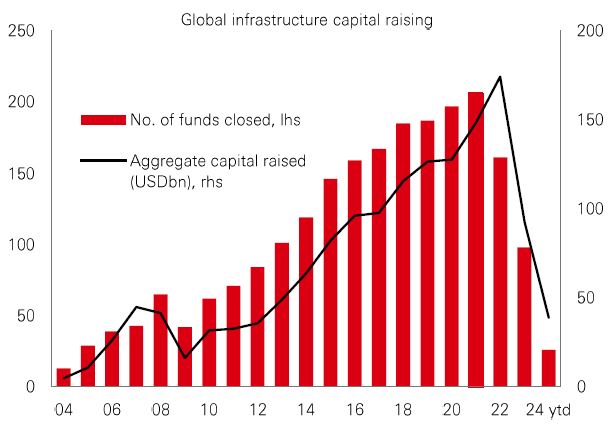

With assets under management of USD1.3 trillion, global infrastructure has been a popular asset class with investors in recent years. While elevated rates and lower deal activity saw fundraising slow and fewer new funds reach target (and close) in 2023, demand for private investment is expected to stay high.

Much of this private capital is earmarked for funding projects in the West. But infrastructure plans in Asia – particularly the region’s efforts to develop new renewable energy generation – are also a key opportunity, and one that could be overlooked by investors.

Asia tends to be unsuitable (and ignored) by large funds that need to invest at scale. That gives mid-market (sub-USD 1bn) funds a broader range of up-front opportunities in smaller projects. It also gives them the ability to have closer involvement in those projects, and more options when it comes to unwinding their exposure later on.

Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future.

Source: HSBC Asset Management. Macrobond, Bloomberg. Data as at 11am UK time 19 April 2024.

Source: HSBC Asset Management. Data as at 11am UK time 19 April 2024.

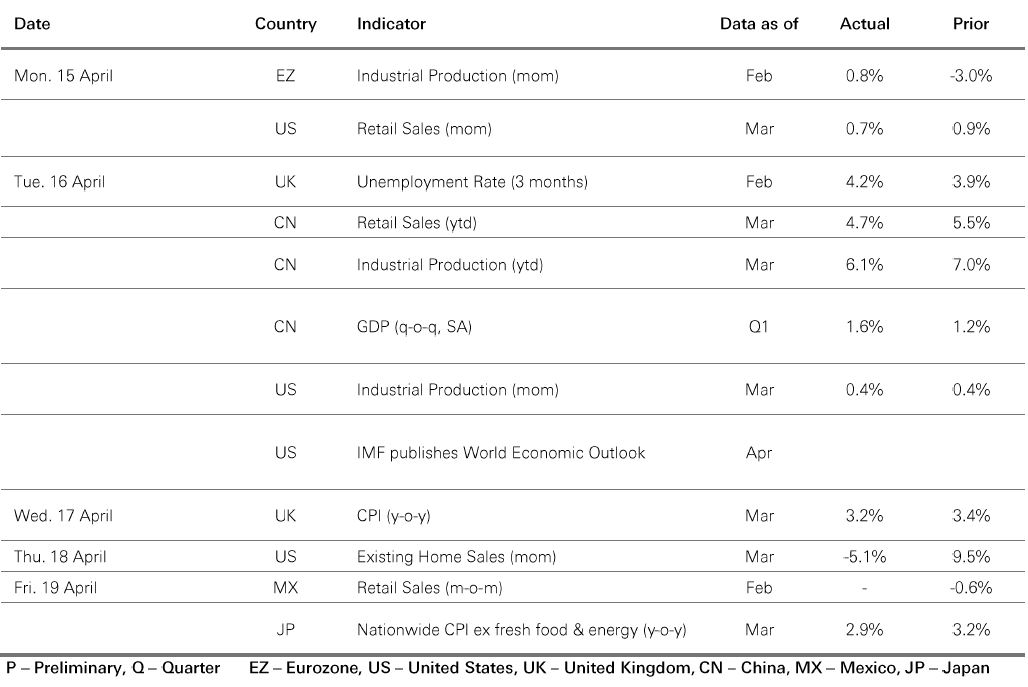

Geopolitical concerns and US rate worries continue to weigh on risk markets. US government bonds were supported by safe-haven flows, with Fed Chair Powell acknowledging that US inflation “will likely take longer” to reach the 2% medium-term target. Further strong US data reinforced market expectations of just one to two rate cuts by year-end. US equities weakened across the board as investors digested Q1 earnings, while the Euro Stoxx 50 index moved sideways. Japan’s Nikkei 225 fell in choppy trading, with the yen stabilising against the US dollar. In EM, the Shanghai composite index rallied on supportive official comments over new investor-friendly stock market rules amid mixed Chinese data, while India’s Sensex index fell. In commodities, oil prices declined during last week as traders weighed the impact of Middle East tensions. Gold continues to hover around all-time highs.