7 Jun 2023

The decline in biodiversity is having an ever-greater impact on human health and well-being services, with linkages to disaster risks, diseases, nutrition, medicine, air and water quality being increasingly recognised.

In this edition, we explore how decreasing levels of biodiversity are negatively affecting human health outcomes and examine the support provided by the Convention on Biological Diversity and its various Parties in restoring balance.

The crucial role of biodiversity in supporting ecosystems and delivering ecosystem services is closely connected to human health. Biodiverse ecosystems provide essential services such as food, clean air, medicine, natural disaster risk reduction and spiritual values, which fundamentally influence the mental and physical health of human populations.

This is increasingly being recognised globally by intergovernmental and subnational parties. The World Health Organization’s (WHO) One Health approach (see below) has been supported by many parties such as the Food and Agriculture Organization (FAO), the United Nations (UN), the World Bank and the Convention on Biological Diversity (CBD).

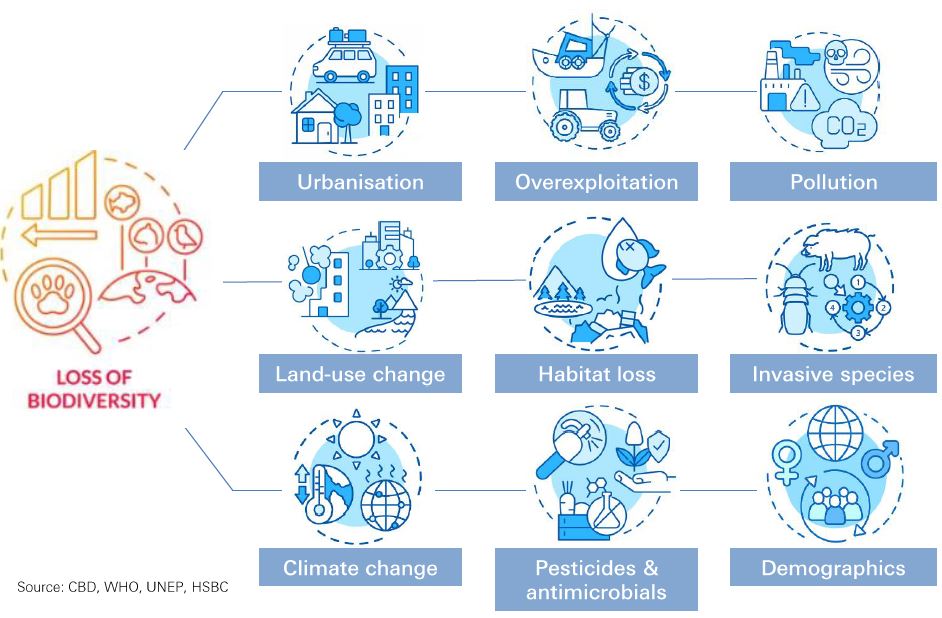

Despite the fundamental role that biodiversity plays in health, its levels continue to decline due to various human activities (Chart 1), which inhibit essential ecosystem services and often lead to negative outcomes for health and well-being. In 2015, the CBD and WHO collaborated on a review of the linkages between biodiversity and health, the risks that biodiversity loss poses to health, and ways forward [@biodiversity-and-health-3]. We dive into these in the following section.

Biodiversity loss poses a risk to the health and well-being of our society across multiple areas which we discuss below.

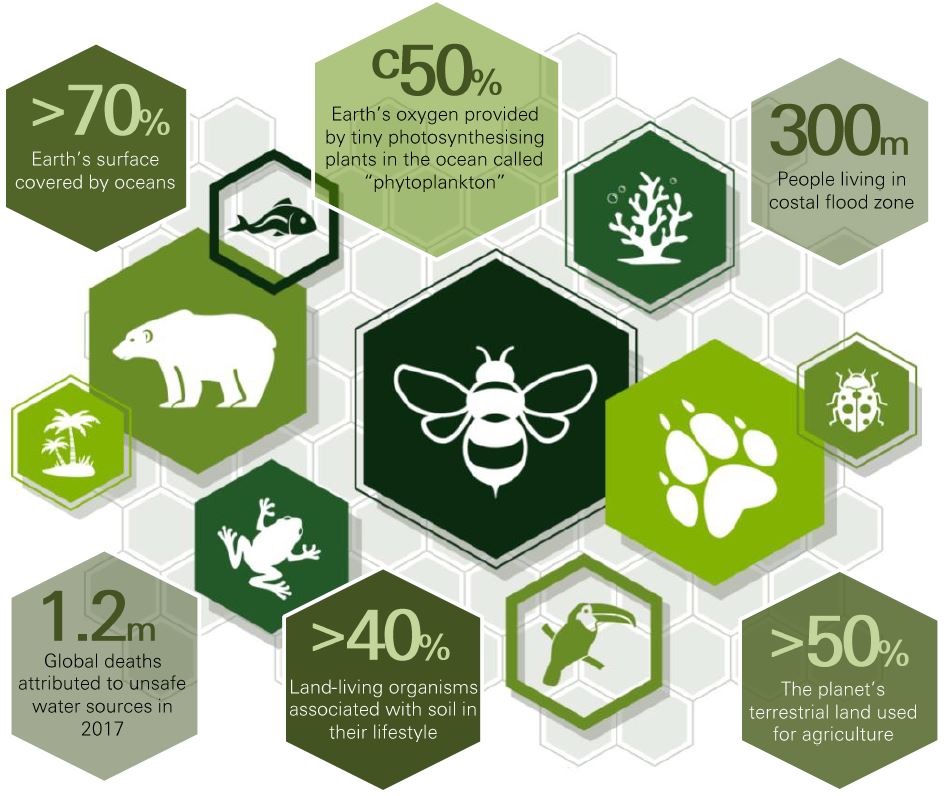

Biodiversity underpins water systems via regulating nutrient cycles, soil erosion, pollution and water purification. However, while clean water is essential for human health, it’s often polluted by water-intensive industries, such as agriculture, textiles and construction as well as mining activities, which put freshwater and mountain ecosystems at risk. Roughly 2.2bn people don’t have access to safely managed drinking water and sanitation services[@biodiversity-and-health-4] and it’s estimated that unsafe water sources were responsible for 1.2m deaths in 2017[@biodiversity-and-health-5], with the most pronounced impacts on women, children and less developed regions.

Clean air is vital for healthy outcomes, yet air pollution was responsible for approximately 7m deaths in 2012, with asthma and chronic pulmonary diseases becoming more prevalent. Biodiverse ecosystems can play a direct role in removing air pollution and altering meteorological patterns to improve air quality.

The agriculture and food sectors play a fundamental part in providing healthy diets and nutrients. However, farming relies on biodiversity to provide services like nutrient cycling, water regulation, pollination and pest control, which are necessary to support above-ground crops. Agricultural productivity has increased significantly over the last 50 years and approximately 50% of the planet’s terrestrial land is now used for agriculture[@biodiversity-and-health-6], but food insecurity and undernourishment remain prevalent globally. Modern agriculture methods rely on synthetic fertilisers, which can destroy ecosystems and increase the vulnerability of these production systems to yield reliable and nutritious food sources for human health[@biodiversity-and-health-7].

Many of today’s infections and diseases are largely treatable with medicine that owes its existence to biodiversity. The discovery of natural products, particularly antibiotics, has contributed significantly to breakthroughs in healthcare. However, with many species threatened by extinction, we risk losing potential pharmacologic resources, which could have long-term impacts to human health.

At the microbial level, humans rely on the diversity within their bodies to regulate bodily systems. The depletion of microbial diversity in the human microbiome, which can result from reduced contact between people and the natural environment, has been linked to a range of non-communicable diseases across the globe, including allergic disorder, asthma and Crohn’s disease.

Pathogen and infectious diseases can likewise be linked to biodiversity. The encroachment of human activities and the destruction of ecosystems can increase the risk of emergence and spread of zoonotic diseases (infections transmitted from animals to humans)[@biodiversity-and-health-8]. The COVID-19 pandemic has highlighted the pressure placed on habitats and the risk of disease outbreaks. It has also drawn attention to the need to address inequities in global health, including access to medicines.

Biodiversity is an integral part of many cultures and traditions, and exposure to natural environments ultimately enhances mental and physical well-being. However, with urbanisation on the rise and an increasing number of people living in these urban areas, we’re depriving ourselves of the physiological and psychological benefits that nature provides.

The impact of climate change on human health is expected to intensify due to damaged food production, the spread of diseases, reduced air quality, heat stress and natural disasters. Sustainable consumption and production are essential because of demographic changes and their impact on biodiversity and the environment as a whole. Behavioural change is key to the transition, which seeks to protect biodiversity, human health and their complex linkages. Nonetheless, biodiversity can also help to restore ecosystems with the resources necessary to reduce greenhouse gases emissions and build resilience to climate disasters.

As biodiversity is integral to sectors that influence health outcomes, such as pharmacy, biochemistry, biotechnology, tourism and agriculture, its health benefits can help to achieve the Sustainable Development Goals (SDGs), particularly Goal 3, which is to promote “Good health and well-being”. Strategies like nature-based solutions, which encompass urban green spaces and regenerative agriculture practices, can help to find harmony between people and nature.

The Convention on Biological Diversity (CBD) has worked to raise awareness of the interlinkages between health and biodiversity in its efforts to safeguard biodiversity. At the 10th Conference of the Parties (COP10) in October 2010, the Strategic Plan for Biodiversity (2011-2020) was adopted, which included 20 Aichi Biodiversity Targets. These targets aim to address the ongoing decline in biodiversity and to promote the sustainable use of natural resources.

Aichi Target 14 explicitly focuses on ecosystem services that contribute to health, livelihoods and well-being, and the CBD also states that all the Targets have potential linkages to health and well-being. This support for biodiversity and health outcomes was further emphasised at COP12 (2014) and COP13 (2016), where increased collaboration was called upon between the CBD, WHO and other organisations to strengthen the implementation of the plan.

As the global health crisis of COVID-19 swept across the world, a draft Global Action Plan for Biodiversity and Health was devised. This plan aims to support Parties in implementing a biodiversity-inclusive One Health approach and to encourage Parties to incorporate biodiversity and health linkages into national policies.

More recently, during COP15 in Montreal last year, a new Kunming-Montreal Global Biodiversity Framework (GBF) to 2030 was adopted. This frameworks covers conservation, sustainable use, access and benefits sharing, as well as the five main drivers of biodiversity loss - changes in land and sea use, exploitation of organisms, climate change, pollution, and invasive alien species.

The health of humans and the health of the planet are intertwined. And healthy ecosystems require a diversity of biological interactions to deliver ecosystems services. To make progress towards the One Health approach, social and economic development therefore needs to support both humans and nature. Investors should be aware of the increasing focus on biodiversity when it comes to health and well-being so they can position for the opportunities that may arise within the theme.

1. This report is dated as at 22 November 2022 .

2. All market data included in this report are dated as at close 28 November 2022 , unless a different date and/or a specific time of day is indicated in the report.

3. HSBC has procedures in place to identify and manage any potential conflicts of interest that arise in connection with its Research business. HSBC’s analysts and its other staff who are involved in the preparation and dissemination of Research operate and have a management reporting line independent of HSBC’s Investment Banking business. Information Barrier procedures are in place between the Investment Banking, Principal Trading, and Research businesses to ensure that any confidential and/or price sensitive information is handled in an appropriate manner.

4. You are not permitted to use, for reference, any data in this document for the purpose of (i) determining the interest payable, or other sums due, under loan agreements or under other financial contracts or instruments, (ii) determining the price at which a financial instrument may be bought or sold or traded or redeemed, or the value of a financial instrument, and/or (iii) measuring the performance of a financial instrument.

This document or video is prepared by The Hongkong and Shanghai Banking Corporation Limited (‘HBAP’), 1 Queen’s Road Central, Hong Kong. HBAP is incorporated in Hong Kong and is part of the HSBC Group. This document or video is distributed and/or made available by HSBC Bank Canada (including one or more of its subsidiaries HSBC Investment Funds (Canada) Inc. (“HIFC”), HSBC Private Investment Counsel (Canada) Inc. (“HPIC”) and HSBC InvestDirect division of HSBC Securities (Canada) Inc. (“HIDC”)), HSBC Bank (China) Company Limited, HSBC Continental Europe, HBAP, HSBC Bank (Singapore) Limited, HSBC Bank Middle East Limited (UAE), HSBC UK Bank Plc, HSBC Bank Malaysia Berhad (198401015221 (127776-V))/HSBC Amanah Malaysia Berhad (20080100642 1 (807705-X)), HSBC Bank (Taiwan) Limited, HSBC Bank plc, Jersey Branch, HSBC Bank plc, Guernsey Branch, HSBC Bank plc in the Isle of Man, HSBC Continental Europe, Greece, The Hongkong and Shanghai Banking Corporation Limited, India (HSBC India), HSBC Bank (Vietnam) Limited, PT Bank HSBC Indonesia (HBID), HSBC Bank (Uruguay) S.A. (HSBC Uruguay is authorised and oversought by Banco Central del Uruguay), HBAP Sri Lanka Branch, The Hongkong and Shanghai Banking Corporation Limited – Philippine Branch, and HSBC FinTech Services (Shanghai) Company Limited (collectively, the “Distributors”) to their respective clients. This document or video is for general circulation and information purposes only.

The contents of this document or video may not be reproduced or further distributed to any person or entity, whether in whole or in part, for any purpose. This document or video must not be distributed in any jurisdiction where its distribution is unlawful. All non-authorised reproduction or use of this document or video will be the responsibility of the user and may lead to legal proceedings. The material contained in this document or video is for general information purposes only and does not constitute investment research or advice or a recommendation to buy or sell investments. Some of the statements contained in this document or video may be considered forward looking statements which provide current expectations or forecasts of future events. Such forward looking statements are not guarantees of future performance or events and involve risks and uncertainties. Actual results may differ materially from those described in such forward-looking statements as a result of various factors. HBAP and the Distributors do not undertake any obligation to update the forward-looking statements contained herein, or to update the reasons why actual results could differ from those projected in the forward-looking statements. This document or video has no contractual value and is not by any means intended as a solicitation, nor a recommendation for the purchase or sale of any financial instrument in any jurisdiction in which such an offer is not lawful. The views and opinions expressed are based on the HSBC Global Investment Committee at the time of preparation, and are subject to change at any time. These views may not necessarily indicate HSBC Asset Management‘s current portfolios’ composition. Individual portfolios managed by HSBC Asset Management primarily reflect individual clients’ objectives, risk preferences, time horizon, and market liquidity.

The value of investments and the income from them can go down as well as up and investors may not get back the amount originally invested. Past performance contained in this document or video is not a reliable indicator of future performance whilst any forecasts, projections and simulations contained herein should not be relied upon as an indication of future results. Where overseas investments are held the rate of currency exchange may cause the value of such investments to go down as well as up. Investments in emerging markets are by their nature higher risk and potentially more volatile than those inherent in some established markets. Economies in emerging markets generally are heavily dependent upon international trade and, accordingly, have been and may continue to be affected adversely by trade barriers, exchange controls, managed adjustments in relative currency values and other protectionist measures imposed or negotiated by the countries with which they trade. These economies also have been and may continue to be affected adversely by economic conditions in the countries in which they trade. Investments are subject to market risks, read all investment related documents carefully.

This document or video provides a high level overview of the recent economic environment and has been prepared for information purposes only. The views presented are those of HBAP and are based on HBAP’s global views and may not necessarily align with the Distributors’ local views. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of its dissemination. It is not intended to provide and should not be relied on for accounting, legal or tax advice. Before you make any investment decision, you may wish to consult an independent financial adviser. In the event that you choose not to seek advice from a financial adviser, you should carefully consider whether the investment product is suitable for you. You are advised to obtain appropriate professional advice where necessary.

The accuracy and/or completeness of any third party information obtained from sources which we believe to be reliable might have not been independently verified, hence Customer must seek from several sources prior to making investment decision.

Important Information about HSBC Global Asset Management (Canada) Limited (“AMCA”)

HSBC Asset Management is a group of companies, including AMCA, that are engaged in investment advisory and fund management activities, which are ultimately owned by HSBC Holdings plc. AMCA is a wholly owned subsidiary of, but separate entity from, HSBC Bank Canada.

Important Information about HSBC Investment Funds (Canada) Inc. (“HIFC”)

HIFC is the principal distributor of the HSBC Mutual Funds and offers the HSBC Mutual Funds and/or the HSBC Pooled Funds through the HSBC World Selection® Portfolio service. HIFC is a subsidiary of AMCA, and indirect subsidiary of HSBC Bank Canada, and provides its products and services in all provinces of Canada except Prince Edward Island. Mutual fund investments are subject to risks. Please read the Fund Facts before investing.

®World Selection is a registered trademark of HSBC Group Management Services Limited.

Important Information about HSBC Private Investment Counsel (Canada) Inc. (“HPIC”)

HPIC is a direct subsidiary of HSBC Bank Canada and provides services in all provinces of Canada except Prince Edward Island. The Private Investment Counsel service is a discretionary portfolio management service offered by HPIC. Under this discretionary service, assets of participating clients will be invested by HPIC or its delegated portfolio manager, AMCA, in securities, including but not limited to, stocks, bonds, mutual funds, pooled funds and derivatives. The value of an investment in or purchased as part of the Private Investment Counsel service may change frequently and past performance may not be repeated.

Important Information about HSBC InvestDirect (“HIDC”)

HIDC is a division of HSBC Securities (Canada) Inc., a direct subsidiary of, but separate entity from, HSBC Bank Canada. HIDC is an order execution only service. HIDC will not conduct suitability assessments of client account holdings or of the orders submitted by clients or from anyone authorized to trade on the client’s behalf. Clients have the sole responsibility for their investment decisions and securities transactions.

Important Information about the Hongkong and Shanghai Banking Corporation Limited, India (“HSBC India”)

HSBC India is a branch of The Hongkong and Shanghai Banking Corporation Limited. HSBC India is a distributor of mutual funds and referrer of investment products from third party entities registered and regulated in India. HSBC India does not distribute investment products to those persons who are either the citizens or residents of United States of America (USA), Canada, Australia or New Zealand or any other jurisdiction where such distribution would be contrary to law or regulation.

The following statement is only applicable to HSBC Bank (Taiwan) Limited with regard to how the publication is distributed to its customers: HSBC Bank (Taiwan) Limited (“the Bank”) shall fulfill the fiduciary duty act as a reasonable person once in exercising offering/conducting ordinary care in offering trust services/ business. However, the Bank disclaims any guarantee on the management or operation performance of the trust business.

The following statement is only applicable to PT Bank HSBC Indonesia (“HBID”): PT Bank HSBC Indonesia (“HBID”) is licensed and supervised by Indonesia Financial Services Authority (“OJK”). Customer must understand that historical performance does not guarantee future performance. Investment product that are offered in HBID is third party products, HBID is a selling agent for third party product such as Mutual Fund and Bonds. HBID and HSBC Group (HSBC Holdings Plc and its subsidiaries and associates company or any of its branches) does not guarantee the underlying investment, principal or return on customer investment. Investment in Mutual Funds and Bonds is not covered by the deposit insurance program of the Indonesian Deposit Insurance Corporation (LPS).

THE CONTENTS OF THIS DOCUMENT OR VIDEO HAVE NOT BEEN REVIEWED BY ANY REGULATORY AUTHORITY IN HONG KONG OR ANY OTHER JURISDICTION.

YOU ARE ADVISED TO EXERCISE CAUTION IN RELATION TO THE INVESTMENT AND THIS DOCUMENT OR VIDEO. IF YOU ARE IN DOUBT ABOUT ANY OF THE CONTENTS OF THIS DOCUMENT OR VIDEO, YOU SHOULD OBTAIN INDEPENDENT PROFESSIONAL ADVICE.

© Copyright 2023. The Hongkong and Shanghai Banking Corporation Limited, ALL RIGHTS RESERVED.

No part of this document or video may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior written permission of The Hongkong and Shanghai Banking Corporation Limited.

Important information on sustainable investing

“Sustainable investments” include investment approaches or instruments which consider environmental, social, governance and/or other sustainability factors (collectively, “sustainability”) to varying degrees. Certain instruments we include within this category may be in the process of changing to deliver sustainability outcomes.

There is no guarantee that sustainable investments will produce returns similar to those which don’t consider these factors. Sustainable investments may diverge from traditional market benchmarks.

In addition, there is no standard definition of, or measurement criteria for sustainable investments, or the impact of sustainable investments (“sustainability impact”). Sustainable investment and sustainability impact measurement criteria are (a) highly subjective and (b) may vary significantly across and within sectors.

HSBC may rely on measurement criteria devised and/or reported by third party providers or issuers. HSBC does not always conduct its own specific due diligence in relation to measurement criteria. There is no guarantee: (a) that the nature of the sustainability impact or measurement criteria of an investment will be aligned with any particular investor’s sustainability goals; or (b) that the stated level or target level of sustainability impact will be achieved.

Sustainable investing is an evolving area and new regulations may come into effect which may affect how an investment is categorised or labelled. An investment which is considered to fulfil sustainable criteria today may not meet those criteria at some point in the future.